The Best Bitcoin Trading Platforms

Bitfinex.com Leverage trading exchange

No US Individuals Allowed

3x Leverage on Bitcoin and Altcoins

Earn Passive BTC by Funding Traders

New Markets: Tezos Margin Trading

Evolve.Markets Bitcoin Powered Trading

U.S. IP Addresses Blocked

100x Max Leverage for Crypto

Trade Bitcoin w/ MT5

New Markets: XTZUSD & XAUBTC

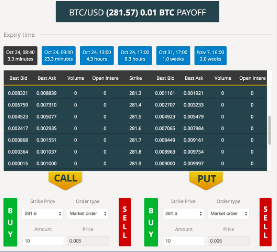

Deribit.com Bitcoin Futures & Options

U.S. IP Addresses Blocked

100x Bitcoin Futures

ETH Perp Swaps

Lowest Trade Fees

SimpleFX.com Forex Trading Platform

U.S. IP Addresses Blocked

Bitcoin CFDs with 5x Leverage

Forex, Stocks, CFDs 1:1500

BTCCNY, BTCUSD, BTCEUR, BTCJPY

OKCOIN.COM BITCOIN SPOT AND MARGIN TRADING

No Leverage for U.S. Customers

Up to 10x Leverage

High Borrowing Limits

One of the Oldest Exchanges!

What Are Bitcoin Derivatives?

Derivatives Trading Lets You Bet On The Future Price Of Bitcoin

A derivative is a contract that 'derives' its value from the performance of an underlying asset sometime in the future. A bitcoin derivatives market is where you can buy or sell bitcoin futures contracts if you are confident in which direction the bitcoin markets will move. Most derivatives have a settlement date on which all contracts are finalized and your position is liquidated. Bitcoin derivative markets allow traders to leverage their position and make a profit whether the price of bitcoin goes up or down.

In a 'Long' position you are borrowing fiat currency such as USD to buy bitcoin with a goal of selling that bitcoin at a higher price.

In a 'Short' position you are borrowing bitcoins to sell for a fiat currencies with the goal of buying bitcoins back at a lower price.

When your trade ends the loan is repaid and you keep all the profits.

Bitcoin Market Comparison

BTC Spot Trading

BTC Margin Trading

BTC Futures Trading